ITR processed or not

Verification: The return filed by the assesse is verified by him either through online or by sending the hard copy of the signed ITR verification form ( ITR V ) to the Central Processing Centre (CPC), Bangalore within 120 days of filing of ITR.

Processing: After verification the ITR is processed wherein the data available with the tax department such as Form 16 data, tax withholding information reflected in Form 26AS etc. are matched and an intimation under Section 143(1) of the Income Tax Act, 1961 is issued which indicates refund due/tax payable by the tax payer.

What situations/ occurrences/ events classify as Force Majeure?

Situations which are outside the control of the contracting parties classify as Force Majeure events. Few examples of such events are: Act of God, War, Floods, Earthquakes, Any natural calamity, Terrorism, Government Intervention, Sudden change of Government policies, etc.

Vide its Office Memorandum No. F.18/4/2020-PPD dated 19th February 2020, issued by Government of India, Ministry of Finance, Department of Expenditure, Procurement Policy Division to the Secretaries of all Central Government Ministries/ Departments clarified that “A doubt has arisen if the disruption of the supply chains due to spread of coronavirus in China or any other country will be covered in the Force Majeure Clause (FMC). In this regard, it is clarified that it should be considered as a case of natural calamity and FMC may be invoked, wherever considered appropriate, following the due procedure as above. Hence, COVID-19 pandemic will be treated as a force majeure event.

Furthermore, the Office Memorandum clarifies that if there is a delay in performance in part or in whole of its contractual obligation during the force majeure event for a period of more than 90 (ninety) days, the parties gets the option to terminate the contract without financial worry from either side.

Check Your Status:

- The status of the tax return filed can be checked by logging on to the income tax e-filing website of the income tax department- incometaxindiaefiling.gov.in

- Click on my account>View return/forms

- Select “Income tax returns” and click on “submit” on the “acknowledgement number” of the year for which return has been filed to view the detailed status of the return

If ITR is not processed:

If the return of income has not been processed, a taxpayer may file a grievance petition with CPC/Assessing officer online in his account in the income tax portal.

Your Return Includes Inaccurate Information

This can add days or weeks to the processing time of return and in turn delay in refund.

Mismatch In TDS Credit as per Form 26as

There are several reasons due to which tax credit as seen in the Form 26AS might not match with the amount actually deducted as shown in the salary slips. Some of these reasons could be – amount of tax deducted from salary is not correctly reported by the employer, TDS deduction is reported in wrong section, amount deposited with government as TDS is wrongly mentioned, incorrect pan submitted by employee or incorrect PAN entered in TDS return by the employer etc.

In non-salary TDS, the error might arise as the deductor inadvertently miss the transaction while filing the TDS return or fills wrong particulars of the deductee in the TDS return

Hence In cases where TDS has been deducted by the deductor but the transaction is not reflecting in Form 26AS or incorrect TDS amount is reflecting, the TDS return has to be rectified by the deductor.

This mismatch can lead to delay of refund or receipt of a lower amount of refund.

Mismatch In Self – Assessment Tax Paid As Per Form 26as

If any error has been made while depositing self-assessment tax or advance tax, then the same can be corrected by making an application jurisdictional assessing officer as the power of correction of challan lies only with the assessing officer. Once the jurisdictional Assessing Officer rectifies the same, the correction will automatically be reflected in Form 26AS

This mismatch can lead to delay of refund or receipt of lower amount of refund.

Revision or Rectifcation of Return

Refund Pending with Refund Banker

There are 2 modes of Refund by which Income tax department process refund:

ECS Method: The refund amount will be credited into the bank account of the taxpayer. The details about the bank account are filled in the relevant ITR form.

By paper (Cheque) : The Income Tax Department will carry out the refund by sending cheque to the mailing address of the taxpayer.

Refund can be pending with the refund banker due to following probable issues:

Bank account not pre-validated: The department has strictly issued a criteria for getting refund is to “Pre-validate Your Bank Account” which can be done by:-

< Login to E-filing portal> Enter your credentials> Go to Profile Settings> Prevalidate Your Bank Account > Click on Add > Enter Basic Details > Click Prevalidate>

Address Issue: The address provided to the Income Tax Department while filing for ITR might be wrong. As a result, refund cheque has not reached. The Speed Post Reference Number from the NSDL website should be checked. Then you can get it checked at the Local Post Office and find out the status of the cheque.

Incorrect bank details: The bank details filled in ITR form might be wrong or has changed over the due course of time. So in case of wrong bank account details, a refund re-issue request should be raised. But in case of change of bank account details, necessary steps have to be taken.

Your Refund Has Been Offset To Pay An Outstanding Tax Demand

You have the right to dispute the adjustment of demand by filing a grievance or necessary rectification.

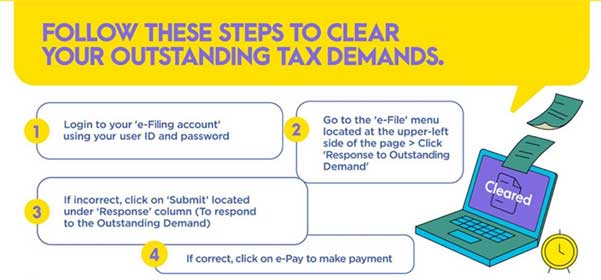

It is hence advised that the taxpayer should check if there are any outstanding demands or not. If they are any steps should be taken to settle that demand by either rectification or payment of the demand to avoid further delays in the refund.

It is also important to respond to all notices or alerts received from income tax department via email or message.