Introduction

Finance Act 2013 introduced Section 194-IA with an intention to curb the indirect inflow of black-money into the Indian real estate sector. Prior to this as well Indian government has always intended to put a stoppage over the cash dealing in the Indian real estate Sector. Section 139A was introduced which makes quoting of PAN mandatory in documents pertaining to purchase or sale of immovable property amounting to INR 5,00,000 or more.

However, it was subsequently noticed by the tax authority that majority of the transactions still doesn’t comply with the provision of Section-139A and only limited persons quote a valid PAN in the conveyance deed. As a measure and a support to the previously introduced provision Tax Department introduced Section 194-IA.

We INMACS via this article attempts to bring you all the much needed clarity over the all provision relating to TDS on immovable property. We hope the readers would find this article informative about all the unsaid difficulty one would face while transferring the immovable property.

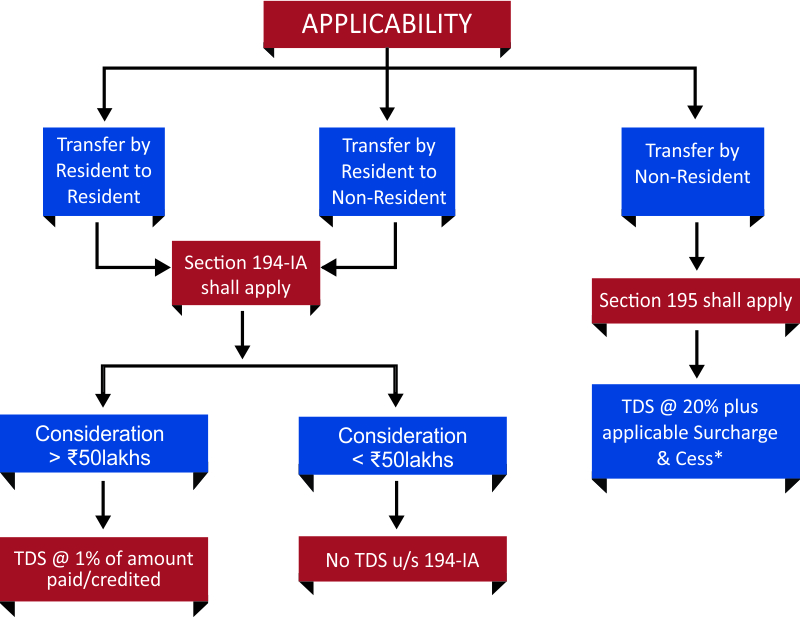

*Since 194IA specifically covers only transfer made by person resident in India.(Resident Buyer)

In this article we have also covered a case where transfer of an immovable property situated in India has made by the non-resident person.

In this article we have also covered a case where transfer of an immovable property situated in India has made by the non-resident person.

In Case Transaction is Between Resident Seller & Resident/Non-Resident Buyer

- Applicability of the Provision

- Provision of section-194IA applies only in case of transfer of immovable property (not being an agricultural land) by a resident person to any person (being resident/non-resident) and

- Where the total consideration paid or to be paid for such transfer of immovable property is ₹50 lakhs or more.

- Rate of TDS and Penalty provision for the Transferee/ Buyer

- While making any remittance/payment to the resident transferor, the transferee is required to deduct TDS @1% of the amount paid/credited, whichever is earlier.

- The person liable to deduct TDS will not be required to obtain Tax Deduction Number (TAN) as required by Section 203A.

- Time Limit of payment: The transferee is required to deposit the TDS so deducted within 30 days from the end of month in which TDS was deducted (as per the Notification No. 30/2016 dated 29th April, 2016).

Eg: A person deducts TDS u/s 194-IA while making a payment for the said immovable property in the month of January, 2020 is required to deposit the TDS so deducted by 1st March, 2020.

- Interest on delayed payment:

- If the transferee fails to pay the TDS so deducted within due time limit as mentioned above, he shall be liable to pay interest @ 1.5% per month or a part of month from the date when the tax was required to be deducted till the date of deduction.

- The transferee shall be liable to pay interest @ 1% per month or a part of month from the date of deduction till the date of actual payment in case TDS is not deducted

Eg: A person deducts TDS on 25th Feb,2020, the due date for deposit of TDS falls to be 31st March,2020, however the actual date for deposit is 25th May 2020. In such a case, the calculation of months for the purpose of interest shall be from 31st March to 25th May i.e. 2 months (since part of month shall be considered as a full month).

- Filling Procedure for Transferee/ Buyer:

- The tax so deducted shall be paid through challan-cum-statement in Form 26QB electronically within 30 days from the end of month in which tax is deducted.

- Any delay in filing such statement within time prescribed shall attract fee u/s 234E which is ₹200 per day during which the failure continues subject to a maximum of amount of TDS deducted.

- Key Points: –

- The underlined fact is that this section will not apply where transfer is being made by non-resident person to any resident/non-resident person. In such a case, the provisions of Section 195 shall come in play (subsequently covered).

However ITAT Delhi Bench in the case of Vinod Soni v. ITO [2019] 101 Taxmann.com 190 opined differently. It’s still a subject matter to a higher judiciary discussion but from our view it’s advisable to the assessee deduct TDS in either scenario.

- The consideration shall include any amount paid as money deposit, advance or by whatsoever name called. Further recent judgement provided clarification that other charges including parking space charges/ one-time club membership charges etc mentioned in the Conveyance Deed shall be included in consideration on which TDS has to be deducted.

- The liability to deduct TDS shall hold good even if the payment has been made by any mode including cash payment.

- The TDS so deducted by the buyer could be claimed by the seller in his/ her return of income for the relevant period.

- The underlined fact is that this section will not apply where transfer is being made by non-resident person to any resident/non-resident person. In such a case, the provisions of Section 195 shall come in play (subsequently covered).

The true motive of government behind introducing such provision is to trace a complete trail of transaction of sale/ purchase of the immovable by the any person. Such trail could help the government to further possibility of benami transaction or transaction violating the PMLA provision.

In Case Transaction is Between Non-Resident Seller & Resident/Non-Resident Buyer

In other words, when any person purchases an immovable property from a non-resident, TDS is required to be deducted on the amount of the capital gain (not on the sale proceeds) arising to such non-resident as per Section 195 of the Income Tax Act. Section 194IA shall not be applicable when the property is purchased from Non-resident Indian.

Deductor |

Buyer of the immovable property |

||||||||||||||||||||

Deductee |

Seller of the immovable property (Non-Resident Indian) |

||||||||||||||||||||

Rate |

The rate of TDS depends on the nature of capital gain arising to the non-resident which are as follows: For Long-term Capital Gain

|

||||||||||||||||||||

Other Key Points

- The computation of capital gain cannot be done by the Seller himself and shall be done only by the concerned Income Tax Officer. In case the certificate is not available then it is advisable to the assessee to deduct the TDS on the whole amount of the sale proceeds with the highest tax rate bracket (including surcharge and cess).

- Section 206AA (TDS at a higher rate if PAN not provided) is not applicable in this case as per the notification issued by Government of India.

- Buyer should have TAN (Tax Deduction and Collection Account Number).

- TDS deducted should have been deposited within 7 days from the end of the month in which TDS is deducted. For example, if TDS is deducted on 28th June then the deposit due date is 07thof July All other TDS return related compliance shall need to be fulfilled.

Note: – It is advisable to surrender the TAN number once the transaction for the purchase of property has been completed in order to avoid notice for non-filing TDS return.