Introduction

- Master File containing standardises information relevant for all multinational enterprises (MNE) group member under rule 10DA (prescribed forms includes Form 3CEAA & Form 3CEAB)

- Country-by-Country Report for the purpose of gathering information related to various different tax jurisdiction and other business operation of international MNC group under rule 10DB (the prescribed form includes: Form 3CEAC, Form 3CEAD & Form 3CEAE)

- Local File to contain maintain transaction of the local tax payer for information related to transaction entered into with associated enterprises under Rule 10D along with Rule 10E (for furnishing the TP report). (prescribed form include: Form 3CEB)

Therefore to help & provide the guidance for such alien provision we have compiled and interpreted the provisions for your ease.

The Governing Provisions

- Section 286 in respect of “Furnishing of report in respect of international group” of Income Tax Act, 1961

- Section 271GB in respect of “Penalty for failure to furnish report or for furnishing inaccurate report under section 286” of Income Tax Act, 1961

- Rule 10DA in respect of “Information and documents to be kept and maintained under proviso to sub-section (1) of section 92D and to be furnished in terms of sub-section (4) of section 92D “ of the Income Tax Rule, 1962

- Rule 10DB in respect of “Furnishing of Report in respect of an International Group” of the Income Tax Rule, 1962

Objective of Master File Documentation and CBCR

- Aid Indian tax authorities to perform TP risk assessment

- Providing information for audit by tax authorities

- To ensure Arm’s Length principle is followed by the Tax Payer

Master File – Rule 10DA

Applicability and Timelines

The master file (MF) is a document which contains high level information about the global business operations and TP policy and economic, legal, financial, and tax context of an MNE group. The information required in the master file goes significantly beyond what is currently included in transfer pricing documentation for any given country.

The MF will usually include standardized information about the group’s organizational structure; significant value drivers; main geographical locations; description of the business activities of members of the group (i.e. products, services, supply chain etc.); information about the group’s intangibles; financing activities within the group (including external funding); and financial and tax positions of the MNE group as well as descriptions (graphic or written) of the supply chain for the five largest products and services, plus other products or services exceeding 5 percent of an MNE’s turnover.

The Guidelines provide that the master file should be made available to all relevant tax authorities in the jurisdictions where the members of the group are resident. Further, the MF may be prepared for the group as a whole or on a line of business basis, provided all centralized functions and transactions are described thoroughly in the MF.

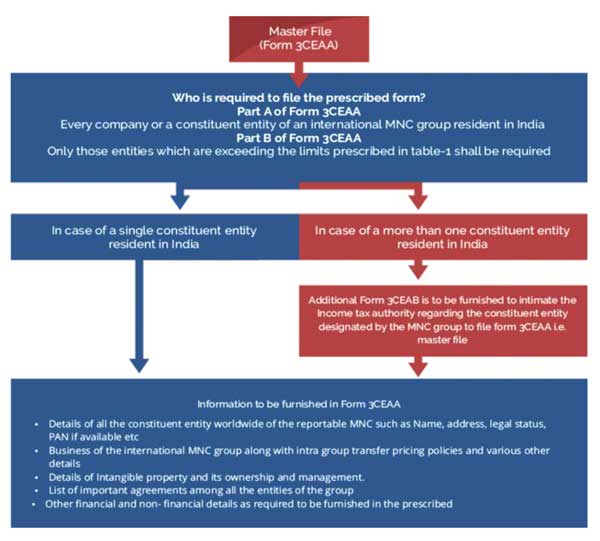

Who is Required to File Master File?

According to the prescribed rule:

Part A of Form No. 3CEAA shall be furnished by every person, being a constituent entity of an international group (resident in India), whether or not the conditions provided in table-1 are satisfied;

Part B of Form No. 3CEAA shall be furnished by a person, being a constituent entity of an international group, in those cases where the conditions as provided in below table-1 are satisfied.

Prescribed limit to file the Master File by Indian CE during the year |

|

Particulars |

Amount* (in INR Crore) |

Consolidated group revenue of the ‘International Group**’ for the accounting year exceeds |

500 |

Aggregate value of international transaction

|

50 10 |

*Rule provides that for the conversion of the limit into the group revenue currency TTBR (’Telegraphic transfer buying rate’) shall be used as on the last date of the accounting the year.

**”international group” means any group that includes,—

- two or more enterprises which are resident of different countries or territories; or

- an enterprise, being a resident of one country or territory, which carries on any business through a permanent establishment in other countries or territories;

Also, Rule 10DA provides the due date of furnishing the necessary information with regards to CbC report. As per the extract of the provisions of sub-rule 2 of Rule 10DA

“2.The report of the information referred to in sub-rule (1) shall be in Form No. 3CEAA and it shall be furnished to the Director General of Income-tax (Risk Assessment) on or before the due date for furnishing the return of income as specified in sub-section (1) of section 139.”

Provided that the information in Form No.3CEAA for the accounting year 2016-17 may be furnished at any time on or before the 31st day of March, 2018.

Therefore the filing of Form No. 3CEAA shall be made latest by 30th day of the November month of every assessment year in case of the company-assessee who are required to furnish TP report u/s 92E. The due date for filing the form 3CEAA for example will be

Accounting Year |

Due Date of filing the form |

2018-2019 |

30th November 2018 |

2019-2020 |

30th November 2019 |

Provisions of Rule 10DA further provides for filing of form-3CEAB to be filed in case of the multinational group having multiple constituent entities (herein after ‘CE’) resident in India. The form-3CEAB shall be furnished by that CE which has been designated by the multinational group to furnish the information under Form-3CEAA. Further the rule provides for filing of form-3CEAB at least thirty days before the due date of furnishing form-3CEAA.

For instance if the designated CE has to furnish form-3CEAA for the FY 2019-20 on or before 30-11-2020, which shall be its due date, then accordingly it has to furnish form-3CEAB on or before 31-10-2020 i.e. 30 days prior to the due date of furnishing of Form- 3CEAA.

In simple words, if there is only one CE in India, form 3CEAB is not required to be filed. In case of two or more CEs resident in India, the international group may opt for the Form 3CEAA to be filed only by one designated CE, the intimation of which needs to be filed in Form 3CEAB at least 30 days prior to the due date of filing the Form-3CEAA.

Reporting Form |

Requirement |

Applicable Due Date |

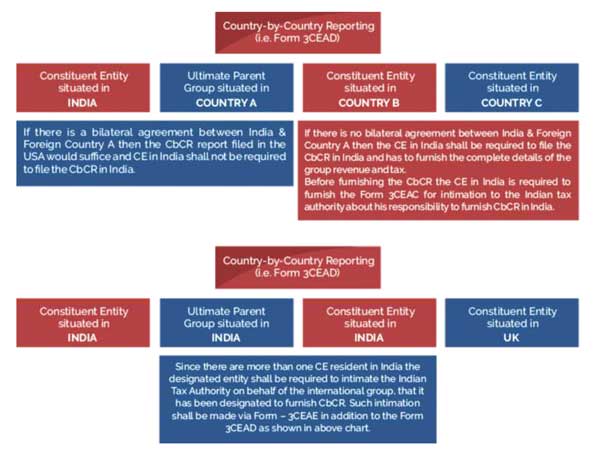

Form-3CEAC (Intimation by a constituent entity, resident in India, of an international group, the parent entity of which is not resident in India) |

Form-3CEAC shall be furnished in case where an international group is having a single CE which is a resident of India and whose group consolidated revenue exceeds the prescribed limit. |

At least two months prior to the due date of furnishing of CbCReport in Form-3CEAD. |

Form-3CEAD (Country-by-country reporting as per section-286) |

Form-3CEAD is to be filed by the resident parent entity or the alternate reporting entity of the international group resident in India. This is the country-by country reporting. Every entity exceeding the prescribed threshold limit of INR 5500 crore is required to file CbC report. |

Within a period of twelve months from the end of the said reporting accounting year |

Form-3CEAE (Intimation on behalf of the international group in case there are more than 1 CE resident in India) |

Form-3CEAE is to be furnished in case Foreign International Group having multiple CEs resident in India - If more than one CE is in India, whose parent entity / alternate reporting entity is a resident in certain jurisdictions – then the Indian CE nominated by the Parent entity in this behalf has to notify in Form No. 3CEAE |

The due date has not been prescribed by the CBDT yet. It seems to have been missed inadvertently; however the same can be aligned to two months prior to the date of furnishing of CbCR as provided for Form-3CEAC.In any case is can be well interpreted that the same should be filed before filing of CBC Report. |

Other Point to be Considered

- The forms are to be filed electronically via Income tax e-filing portal & should be signed by the authorised person competent to verify the ITR, under Section 140 of the Act.

- The exiting requirement for local transfer filing documentation & report remains unchanged. It would still be furnished according to the previous governing rules & provisions.

- If the reporting entity failed to file the prescribed form or furnish inaccurate CbCR, or does not file the forms within prescribed due date monetary penalties have been prescribed under section 271GB of the Income Tax Act’ 1961.

- In recent times, India has entered into a bilateral agreement with many other countries including US, France, UK etc to enable the sharing of such group revenue, function, & tax details of the international MNE under information sharing clause as per the OECDs guidelines.

Our Comments

- CBDT, in an attempt to implement “minimum standards” provided & agreed under Action Plan 13 of OECD’s BEPS project, notified the rules for CbCR and Master File.

- There are a lot of financial as well as non-financial information of the international group companies which is required to be furnished in the Indian Master file& Indian CbCR. This would make a the process of collating information a bit burdensome for the Indian reporting entities as such information is required only by Indian authorities.

- The relatively lower thresholds, particularly for Master File, will bring lot of relatively small and mid-sized CEs within the range of the Master file filing requirements. This could possibly also result in situations requiring the international groups to prepare a Master File only for India, since some of them may not actually have any such requirement under the laws of their respective countries.

- Many companies had expressed their concerns on data confidentiality and security. It is vital for the CBDT to develop an adequate & proper infrastructure for protection of the information furnished by reporting entity.

- Since accounting year followed in India is from April-to-March which is generally different from the accounting year followed by the foreign parent/ Group entities. This issued has been address by the Finance Act 2019; the ministry has confirmed our view of taking the reportable accounting year applicable to such parent entity.

How Inmacs can help:

- Analysing the applicability of these forms for the companies;

- Collating and vetting of data to be filed in these forms;

- Assessing the implications of the details to be provided in these forms;

- This will need deep professional input to ensure that the information given do not result into uncalled for investigation requirment.

- Preparing and filing of the forms mentioned above as per the statute;

- Ensuring timely and proper compliances;

- Advisory relating to any other domestic and international taxation matters.

- Filing of the master file, CBCR and local file duly verfied and approved internationally.